Q4 Report: The Critical Role of Secondaries Beyond 2023

Market overview

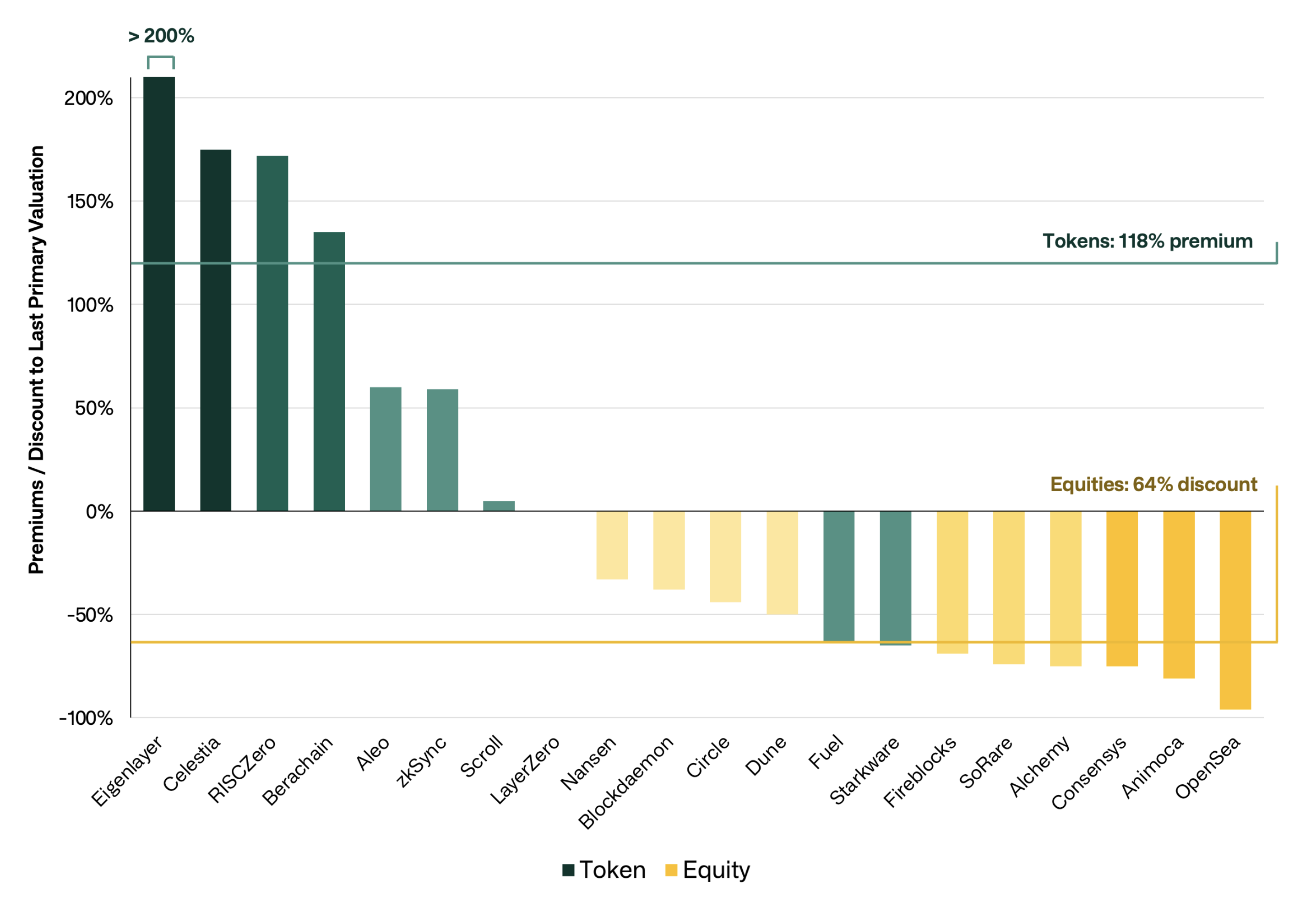

The crypto secondaries market switched into 5th gear in Q4, driven by stronger-than-expected market performance and anticipated token launches. Token positions have shown significant dominance when compared to equity positions, with many of the top tokens trading at premiums while top equities trade at discounts. We view that this is largely attributed to the following:

- Investor liquidity preference: Tokens have seen a stronger bid due to their liquidity, with shorter vesting periods being positively correlated with higher valuations.

- Regulatory uncertainty: Equities have seen a weaker bid due to regulatory overhangs diminishing the likelihood of successful IPOs.

- Highly anticipated projects opting to tokenise: Given investor preferences for tokens, most of the top projects are planning or expected to launch in 2024, aligning strategically with the timing of the Bitcoin halving.

Exhibit 1: Premiums/Discounts for Top 10 Crypto Projects (by Token and by Equity)

Most data is aggregated from previous transactions and/or significant buy-side demand at the price levels shown above.

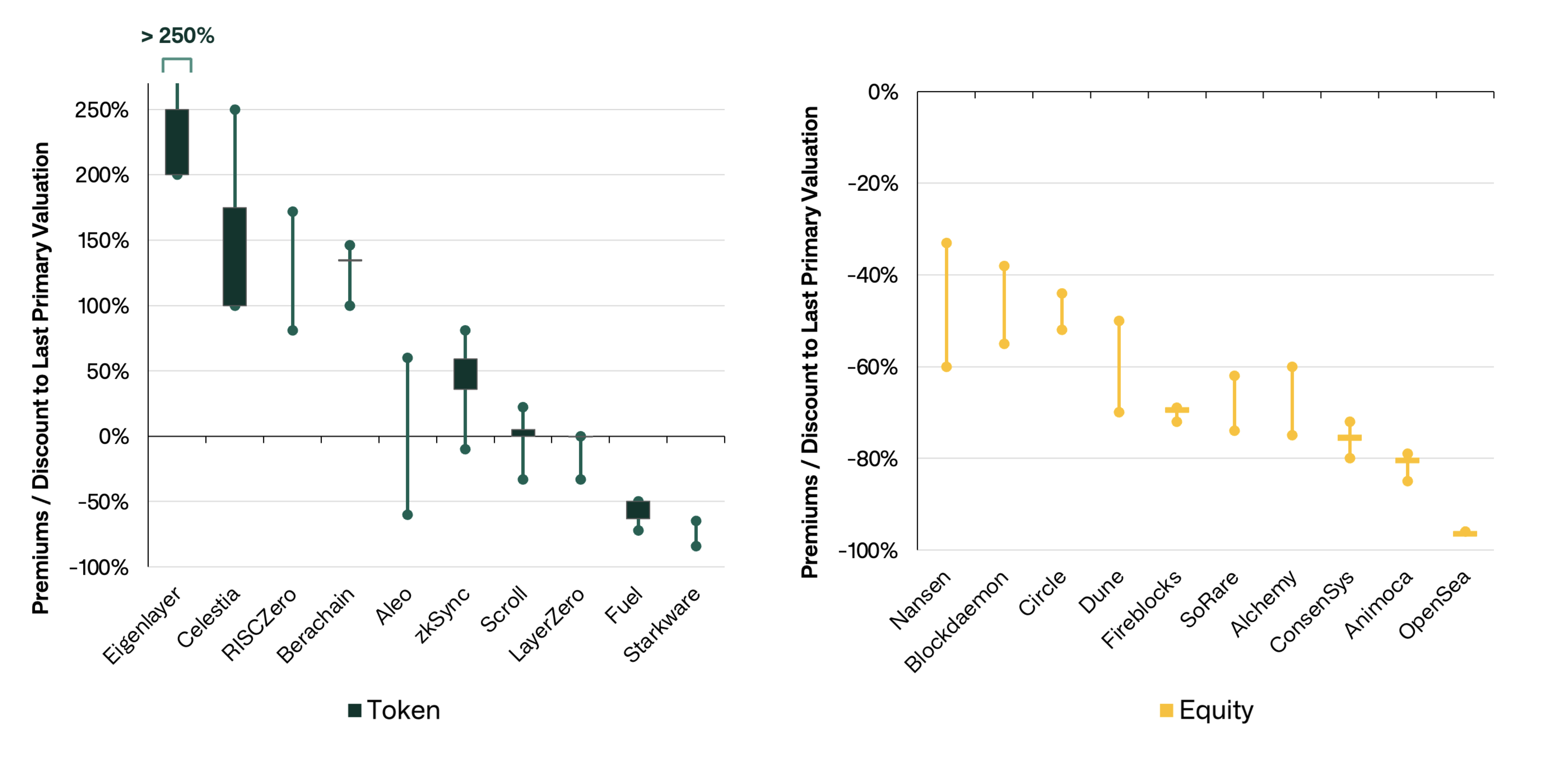

Widening bid-ask spreads

Market inefficiencies are apparent, with buyers lagging behind. A compelling case study is observed in Celestia, where buy-side liquidity started to diminish when OTC prices reached $2.5-2.75B due to the steep premium. However, in retrospect that price was highly attractive considering Celestia's performance since TGE and current fully diluted valuation of over $17.5B as of January 29, 2024. We expect to observe similar patterns in highly anticipated upcoming assets such as Eigenlayer, Monad, Starkware and zkSync.

Exhibit 2: Secondary Market Trading of the Top 10 Crypto Projects (by Token and by Equity)

The body of the candle represents where transactions have executed, the wicks of the candles represent indicative bids and asks.

Hot Themes for 2024

- Modular Blockchains: With the increasing no. of quality L1 and L2s in the market, execution layers are in a prime position to leverage this trend and capture value.

- Layer 1 & Layer 2's: Stronger funding, technology, and marketing from up-and-comers are expected to gather significant retail liquidity from existing chains.

- DeFi Infrastructure: Investors are constantly in the search for yield and liquidity enhancing protocols, giving rise to Liquid Staking Derivatives (LSDs), and other DeFi infrastructure.

- Parallelised EVMs: EVM parallelisation is predicted to disrupt existing blockchains by combining the best features of Solana and Ethereum.

- Decentralised AI: As demand surges for computational power to train increasingly complex models, decentralised AI harnesses distributed computing resources, democratising access to AI by enabling scalable, efficient, and collaborative model development.

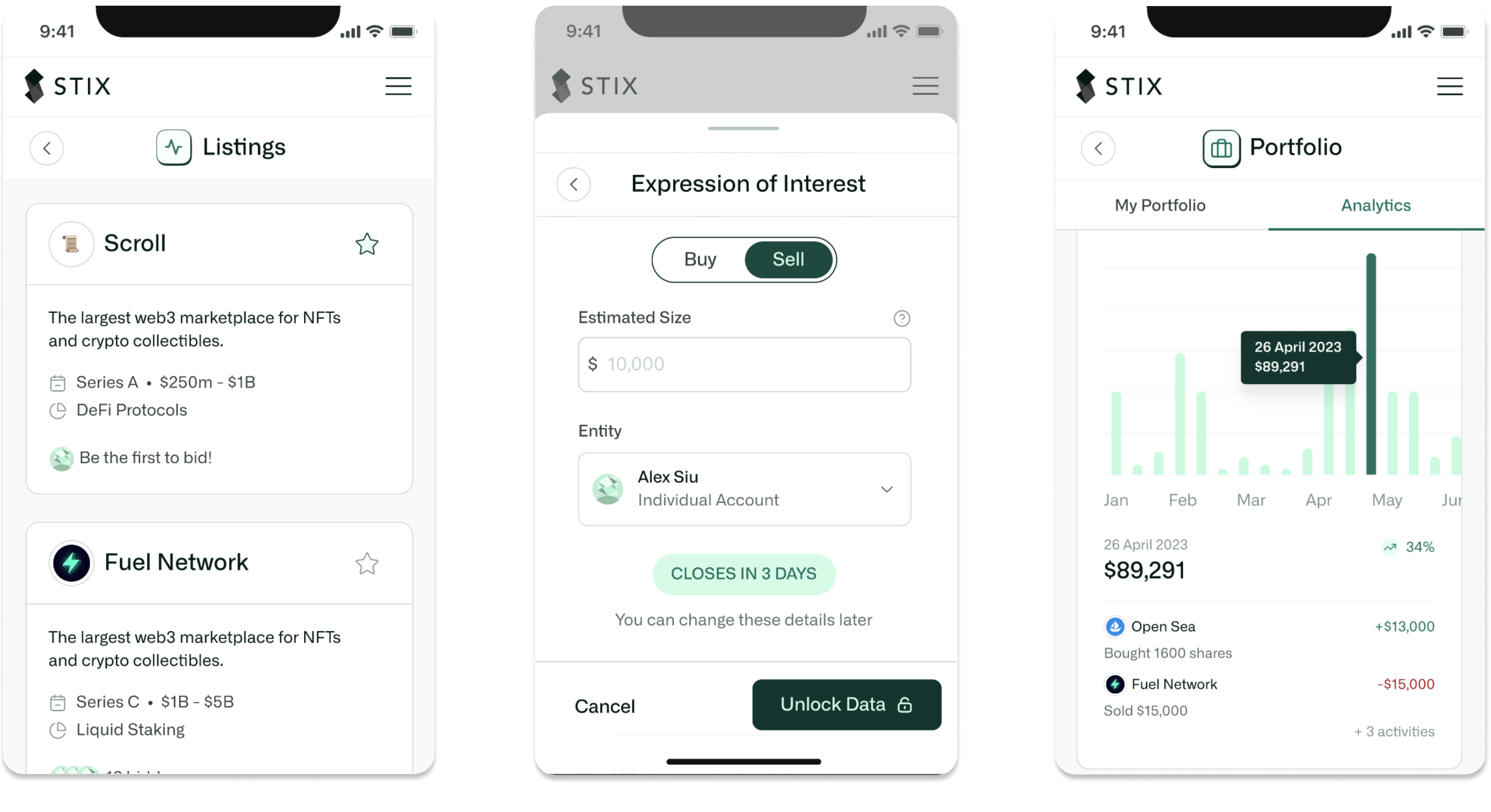

STIX Platform Launch

STIX (app.stix.co) is an EU regulated and compliant crypto secondaries firm with a digital asset trading platform that went live in January 2024. A borderless network where institutional clients can plug in and access unparalleled aggregated data on the crypto private markets.

STIX's expertise and proven procedures enhance deal certainty and efficiency thanks to seamless liquidity rails. The STIX solution benefits the entire digital asset ecosystem from buyers and sellers of assets, to project teams and foundations.

- For project teams, our deal flow is designed to help optimise cap table management as it facilitates the seamless transition of ownership from concentrated and/or short-term holders to long-term investors.

- Sellers, conversely, can be assured that price discovery is optimised via tailored auction strategies.

- Buyers will get the latest market valuations and fair pricing on the highest quality assets in crypto whilst mitigating counterparty risk through direct ownership. The STIX platform also includes a full-suite portfolio management tool, allowing clients to consolidate their positions and tap into the largest database of primary and secondary valuations. Deal negotiations will all be done via dark pool, ensuring identity protection across the platform.

Foundation Treasury Sales

Protocol treasuries have historically struggled with poor liquidity and highly concentrated holdings (e.g. their native token). They've traditionally used market makers but have shied away from engaging in OTC transactions for a multitude of reasons, most notably, lack of market data and distribution capability. OTC raises are also accompanied by headline risk, with the potential negative market impact that can occur when a treasury is perceived to sell its own native token.

To address this, STIX is building a structured and “discretion and privacy-first” approach to private offerings (“STIX Offerings”) for native tokens. STIX Offerings provide treasuries with the ability to leverage STIX's data and insights to assess market pricing, demand, and optimal vesting terms as well as take advantage of our private distribution network to ensure discretion and minimise headline risk. STIX Offerings would enable buyers to purchase locked tokens (with optimised unlock terms) at a discount to the market price whilst giving protocol treasuries the ability to directly and privately interact with buyers on a one-off of recurring basis.

Key Advantages of Using STIX

- Vetted and curated network of buyers:

- Our secondary buyers are predominantly long-term, private investors as opposed to short-term traders

- Highly sophisticated private equity / venture capital investors who have a long track record of adding value to their portfolio companies

- Strong track record of working together with them on private transactions

- Long-term focus with fully compliant rails:

- Long term relationship mindset vs short-term transactional mindset, which is exemplified in everything we do and every interaction we have

- Compliant rails to conduct these OTC transactions with minimised counterparty risk

- Only VC-backed OTC secondaries firm

- Privacy and Confidentiality:

- Confidentiality is the key pillar to STIX's business success which is why we have built this into our DNA and Standard Operating Procedures.

- Our policies and procedures ensure that every transaction is treated with complete privacy including NDAs which are strictly enforced, extensive employee training, and limited access internally to key executives.

Liquidity Solutions

Secondary transactions have emerged as sophisticated solutions to address the growing needs and complexities of the private equity landscape. These transactions deviate from the traditional limited partner (LP) interest sales and often involve customised solutions for both general partners (GPs) and LPs.

-

Fund Continuation / Recapitalisations: The assets of an existing fund are sold to a new fund, typically with a fresh term structure, and managed by the same GP. Existing LPs can either roll their interests into the new fund or liquidate their positions.

-

Stapled Secondaries: This involves the sale of existing LP interests or single assets combined ("stapled") with a commitment to the GP's new fund. Secondary buyers purchase existing fund interests or single assets and also commit to providing fresh capital for the GP's next fund.

-

Single Asset Secondaries: Instead of selling an entire portfolio or fund interest, a single asset (usually a high-performing company or property) is carved out and transferred to a new special purpose vehicle (SPV). Existing LPs can choose to stay invested in the SPV or liquidate their positions.

-

Structured / Preferred Equity Solutions: A secondary buyer provides capital in exchange for equity/preferred equity in a fund or a portfolio of assets. This is not a direct purchase of existing interests but rather an infusion of liquidity that sits between debt and equity in the capital stack.

If you are interested in learning more about anything in this report, please reach out to Jeff Lavoie (jeff.lavoie@stix.co) or Alex Siu (alex.siu@stix.co).

Legal Disclaimer

For Institutional Professional Investors only - not for distribution to retail clients.

This material is intended to be of general interest only and should not be construed as individual investment advice or a recommendation or solicitation to buy, sell, or hold any security or to adopt any investment strategy. It does not constitute to legal or tax advice. The views expressed are those of the firm and the comments, opinions, and analyses are rendered as at publication date and may change without notice. The information provided in this material is not intended as a complete analysis of every material fact regarding any country, region or market. This material is made available by the following STIX Global LLC entities in those countries where it is allowed to carry out relevant businesses.

The information and proposals contained in this report are preliminary and are subject to further revision and amendment. Certain information contained herein has been obtained from published and non-published sources prepared by other parties, which in certain cases has not been updated through the data hereof. While such information is believed to be reliable for the purpose used herein, the firm does not assume any responsibility for the accuracy or completeness of such information and such information has not been independently verified by it. No reliance may be placed for any purpose whatsoever on the information contained in this report or on its completeness. No rereport or warranty, expressed or implied, as to the accuracy or completeness of the information or opinions contained within this report.

This report may contain "forward-looking statements". Because such forward looking statements involve risks and uncertainties, actual results may differ materially from any expectations, projections or predictions made or implicated in such forward-looking statements. Any opinions, projections, forecasts and forward looking statements are speculative in nature, only valid as the date hereof and are subject to change. Prospective investors are therefore cautioned not to place undue reliance on such forward-looking statements. In addition, in considering the prior performance information contained in this report, prospective investors should bear in mind that past results are not necessarily indicative of future results. Investments or a comparable type in comparable instruments or industries to those in which prior funds have invested to date may not be available in the future and investments in future may be made under different economic conditions.

Prospective investors are not to construe the contents of this report or any prior or subsequent communication from the firm or any of its representatives or affiliates, as legal, tax, or investment advice. Each prospective investors should consult with and rely on his, her, or its own personal counsel, accountant, or other advisors as to legal, tax, and economic implications of an investment and its suitability for such prospective investor.

The subject matter of this report is evolving and subject to further changes by the firm in its sole and absolute discretion; provided, however, that except as otherwise indicated herein, this report speaks as of the date hereof and neither the firm nor any affiliate or representative thereof assumes any obligation to provide any recipient of this report with subsequent revisions or updates to any historical or forward-looking information contained in this report to reflect the occurrence of events and/or changes in circumstances after the date hereof.